Using Garner

Our step by step guide will help you understand how your benefit works. Once you’ve got it down, you’re good to go!

Make your account

Yes, this is where we ask you to make an account. To get reimbursed for out-of-pocket expenses, you have to make an account and find your doctor before your appointment. Don’t worry. It won’t take more than two minutes.

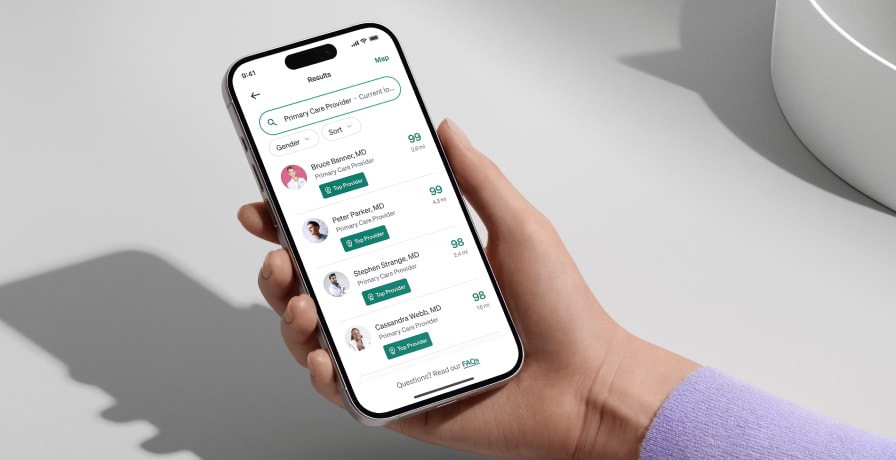

Find Top Providers

Garner ranks doctors based on real patient outcomes, using the nation’s largest medical database. You can seamlessly search for doctors in your area by symptom or name. Those with a Top Provider Badge are eligible for reimbursement up to your benefit amount for things like copays, office visits and medical tests.

Check your Approved Providers

Double (and triple) check your Approved Providers List to make sure your doctor was added before the date of your appointment to be eligible for reimbursement. To access your list, go to “settings” in your account.

Enjoy better health for less.

Not all doctors are created equal. Garner’s Top Providers keep their patients healthier for longer and help them recover quicker, all while saving them 27% on healthcare costs each year.

Reimbursement done for you.

You don’t have to lift a finger. When you receive care from a Garner Top Provider, simply pay your upfront costs as usual. After your health insurance processes the claim, Garner will reimburse you for qualifying out-of-pocket medical costs.

Have a question?

Find answers to the most commonly asked questions from our members and learn more about your Garner benefit.

Our aim is to help you navigate your benefits with ease and confidence, ensuring your Garner experience is even more rewarding.

Frequently asked questions

Below, you’ll find answers to the most common questions you may have about your Garner benefit. If you still can’t find the answer you are looking for, contact us!

About Garner

Is Garner my health insurance?

No. Garner is not your health insurance. It is an additional benefit that compliments your health insurance plan by helping you connect with in-network providers who offer quality care, have availability, and deliver optimal patient outcomes. By choosing these Top Providers, you not only ensure top-notch care but also become eligible for reimbursement of qualifying out-of-pocket medical costs.

If I create an account, am I obligated to see Garner’s Top Providers?

No. While we encourage you to see Top Providers to ensure you are receiving the best care, you have the choice to receive care from a doctor who is not a Top Provider. Out-of-pocket costs from these doctors will not qualify for reimbursement.

Why did my organization add Garner to my plan?

Your organization cares about your health. In order to help you find the best care, they pay for you to have the Garner benefit. Because receiving better care results in better outcomes with fewer complications, patients who see Top Providers will generally pay less in the long run and be healthier overall. Garner helps your organization pass these savings along to you through an innovative health reimbursement arrangement (HRA) that incentivizes getting the best care and staying healthier. It’s a win-win for everyone involved.

Can my family use my Garner benefit?

Any dependent covered by your health insurance plan is eligible to use Garner to find Top Providers and can be reimbursed for qualifying out-of-pocket medical costs. Your family only needs one account, but any dependent aged 18 or older is welcome to create their own account. Reimbursement checks will be mailed to the primary member who holds the health insurance plan.

How do I see more details about my Garner benefit?

You can log in to your Garner account and view more details here.

How do I use the app in Spanish?

To use the app in Spanish, log into your Garner account and navigate to your account settings here. Under the “Language” section, choose “Spanish” from the drop-down menu.

Finding Top Providers

What is a Top Provider?

Top Providers are the best-performing medical professionals that Garner has identified through an analysis of over 60 billion medical records representing more than 310 million unique patients. Top Providers are the top 20% of all providers in the industry. They are highlighted in the Garner Health app with a green Top Provider badge and represent the best available doctors near you who are in your network and have appointment availability.

Are Top Providers in-network with my health insurance plan?

We try our best to recommend Top Providers that are in-network with your health insurance plan. Since insurance companies change their networks regularly, we always recommend verifying with your health plan that a provider is still in-network on or before the day of service.

How do I find and add Top Providers to my list of approved providers?

Find doctors by searching by symptom or for your doctor’s name and zip code. Doctors with a Top Provider badge are eligible for your Garner benefit and are automatically added to your list of approved providers as soon as their Top Provider badge is visible on your screen. The Concierge may also add approved providers to your account. Just remember, all providers must be in-network and your health insurance plan must cover the services you receive for any out-of-pocket costs to be eligible for reimbursement.

Where can I view my list of approved providers?

To view your approved providers list, please log into your Garner account and navigate to the "Settings" page and select "Approved providers" in the menu.

Do I need to add my approved providers to my account every year?

No. Your list of approved providers carries over each year.

Do the Garner Top Provider rankings ever change?

Yes. Garner Top Provider recommendations are updated monthly based on the latest data. However, if a member has previously added a Garner Top Provider to their list of approved providers, any recommendation updates will not affect the provider’s approved status for that individual member and their dependents.

Are all providers at the same practice, medical center or physician group approved for the Garner benefit?

No. Garner evaluates the performance of individual doctors, not entire medical centers or hospitals. Use the Garner Health app to search for specific providers by name to see if they are a Top Provider and approved for your Garner benefit.

What if I see a mid-level provider, such as a nurse practitioner or physician’s assistant, instead of my approved doctor?

If you have an appointment with a Top Provider or an approved primary care physician, and a nurse practitioner in their practice sees you instead, the costs from that visit will qualify for reimbursement. To ensure your claim is processed as quickly as possible, message the Concierge through the Garner Health app and ask to have the nurse practitioner’s name added to your list of approved providers, even if it is after the date of service. Otherwise, we may deny your claim until we are able to associate the mid-level provider you saw with a provider that has been added to your list of approved providers.

What if a colleague recommends a Top Provider they found through Garner? Do I still need to add that provider to my list of approved providers?

Yes. Even if your colleague found the Top Provider through Garner, you must search for that provider using your Garner account and add them to your list of approved providers before you receive care from them. Top Providers are automatically added to your list of approved providers as soon as their Top Provider badge is visible on your screen.

How do I know whether the specialist I have been seeing will be approved for my Garner benefit?

Search for your specialist by entering their name and zip code. If your specialist has a Top Provider badge, qualifying out-of-pocket medical costs from services performed or ordered by that specialist are eligible for reimbursement on or after the date you add them to your list of approved providers. If your specialist is not an approved provider, you can still choose to receive care from them, but those out-of-pocket medical costs will not qualify for reimbursement.

What if my approved provider recommends I see a specialist?

All new providers, including specialists, MUST be Top Providers in order to qualify for the Garner benefit. If you need to find a new provider, use the Garner Health app to find a Top Provider or contact the Concierge for assistance. Specialists must be added to your list of approved providers prior to the date of service in order for out-of-pocket medical costs to qualify for reimbursement. For example, if your PCP recommends that you see a GI specialist for stomach pain, you must check with Garner to ensure the specialist is a Top Provider, and then add them to your list of approved providers before your date of service.

Qualifying Costs

What qualifying out-of-pocket medical costs will be reimbursed?

Garner reimburses qualifying out-of-pocket medical costs that include office visits, lab work, imaging and procedures ordered or administered by your approved providers. To learn if other medical costs qualify for reimbursement, log into your Garner account and navigate to the benefit section.

Your out-of-pocket medical costs will qualify for reimbursement if:

You have created a Garner account and added the provider to your list of approved providers prior to the date of service.

Your provider is in-network and the cost was covered by your health insurance plan.

The type of cost qualifies for reimbursement under your Garner plan.

If your health insurance plan is paired with an HSA, you will need to incur costs greater than the minimum deductible.

When are services from facilities such as labs and imaging eligible for reimbursement?

When a Top Provider orders labs or imaging, these costs automatically qualify for reimbursement if:

The Top Provider was on your approved providers list before the date of service.

The facility is in-network and the services provided are covered by your health insurance plan.

In this case, you do not have to find the facility in the Garner Health app. If you would like to locate a facility on your own, recommendations for labs and imaging centers can be found in the Garner Health app. Out-of-pocket medical costs at these facilities qualify for reimbursement, when the following conditions are met:

You locate the facility in the Garner Health app or website before your date of service.

The facility's profile page displayed a yellow banner stating "eligible with some exceptions." This indicates that out-of-pocket medical costs for the service you are seeking at that facility qualifies for reimbursement.

The facility is in-network and the services provided are covered by your health insurance plan.

While we strive to ensure recommended facilities are in-network with your health insurance plan, this information is subject to change. We recommend confirming with the facility before your appointment.

Garner does not recommend specific hospitals or facilities beyond those listed above. To seek care at a hospital or another facility type, search for the specific provider in the Garner Health app or website. If they are a Top Provider, they will be approved for your Garner benefit.

Can I get reimbursed for ancillary providers that I can’t select, such as an anesthesiologist who assists with surgery?

We understand you can’t choose ancillary providers such as anesthesiologists, radiologists and nurses. Your Garner benefit will reimburse all qualifying out-of-pocket medical costs if:

The approved provider is added to your list of approved providers prior to your appointment.

The approved provider is ordering or is primarily performing the service.

The service is in-network with your health insurance plan. To confirm coverage, check the list of services on your health insurance card or call the number on the card. If you have an online account with your health insurance provider, log in to your portal to confirm coverage details.

Does Garner reimburse out-of-pocket costs for dental and vision care?

Garner works with your medical insurance, which generally does not cover dental or vision services. Garner may reimburse qualifying out-of-pocket medical costs for procedures such as oral surgery, but only if the claim for that service is processed by your medical insurance plan.

If I don’t use my health insurance plan to pay for procedures, can I still get reimbursed by Garner?

No. Garner reimbursement occurs after costs are processed by your health insurance plan. Your health insurance plan must cover qualifying medical care and you must submit your out-of-pocket expenses to your insurance company for them to be eligible for reimbursement.

Can I be reimbursed for prescriptions?

For more information on the services covered by your benefit, please log into your Garner account and view your benefit details.

Reimbursement Process

How does reimbursement work?

When you receive care from an approved provider, pay your upfront costs as usual. Garner has access to your insurance plan’s claims. After your health insurance company processes the claim, Garner will reimburse your qualifying out-of-pocket medical costs.

You have two options for receiving reimbursement:

If you are the primary member you can set up direct deposit for faster and more secure reimbursement. Because the speed that billing departments submit claims to your health insurance company can vary, it typically takes 5-6 weeks to receive reimbursement after the service takes place. Watch this demo video to learn how to set up direct deposit.

If you do not set up direct deposit, a reimbursement check in a white envelope will be sent to the mailing address the primary member has on file with their employer, arriving in about 6-8 weeks

How will my reimbursement arrive?

You have two options for receiving reimbursement:

If you are the primary member you can set up direct deposit for faster and more secure reimbursement. You will receive your reimbursement directly to your bank account and faster than a check. Watch this demo video to learn how to set up direct deposit.

If you do not set up direct deposit, a reimbursement check in a white envelope will be sent to the mailing address the primary member has on file with their employer.

What if I have a question about a reimbursement?

You can reach out to the Garner Concierge for answers to your reimbursement questions by messaging them.

What if I have more questions about what Garner will reimburse?

To learn more about what medical costs qualify for reimbursement, log in to your Garner account and check your benefit details or message the Concierge.

HSA and FSA Process

What if I have an HSA?

An HSA is a Health Savings Account (HSA). You and your organization are able to contribute pre-tax dollars to this account. Because of IRS requirements, two main rules apply.

First, if you have a high-deductible health insurance plan (HDHP) that is paired with an HSA, you are required to spend a minimum amount toward your health insurance deductible before you can utilize your Garner HRA. This amount changes annually and depends on whether you have a family or individual plan. Check the “Your benefit” page in the Garner Health app for more detailed information about this amount. Note that this rule applies even if you are not actively contributing to your HSA this year.

Second, you may not request reimbursement from your Garner HRA for any out-of-pocket cost you have already paid for using funds from your HSA. This is often referred to as double dipping and is prohibited by the IRS.

How does Garner work with an HSA?

If you have a Health Savings Account (HSA) paired with a High-Deductible Health Plan (HDHP), you must first spend the minimum amount toward your health insurance deductible. Once you have spent that amount, you can use the Garner Health Reimbursement Arrangement (HRA).

You are not required to spend HSA dollars on Garner-approved providers. However, we encourage you to seek care from Top Providers.

Garner keeps track of the claims we receive from your health insurance. Once you have spent $1,600 for individuals or $3,200 for families in 2024, or $1,650 for individuals or $3,300 for families in 2025, we will start issuing reimbursement checks for qualifying out-of-pocket medical costs.

Meeting your deductible doesn’t mean you have to wait to start using Garner. You can still set up a Garner account, search for doctors in advance of your visit, and ensure that your qualifying out-of-pocket medical costs will qualify for reimbursement as soon as you meet the IRS out-of-pocket requirement.

What if I have an FSA?

If you have a health Flexible Spending Account (FSA), special rules apply to your Garner benefit. You may not be reimbursed by the Garner HRA for an out-of-pocket medical cost that will also be paid using your FSA. This is often referred to as double-dipping and is prohibited by the IRS. If your Garner HRA and your FSA cover the same medical cost, we recommend you use and exhaust your Garner funds before using your FSA. You can save your FSA for when your Garner benefit has reached its limit or for out-of-pocket medical costs that do not qualify for reimbursement by Garner.

Concierge Support

What is the Garner Concierge?

The Garner Concierge is a group of professionals dedicated to answering your questions and helping you find the best care for you and your family. If you need help finding a Top Provider that is a fit for you or your family, you can message the Concierge for assistance.

How do I contact the Garner Concierge?

You can message through the Garner Health mobile app or email concierge@getgarner.com. The Concierge team is available Monday through Friday from 8:00 a.m. to 8:00 p.m. ET. Se habla español.

Can't find the answer you're looking for?

Our dedicated Concierge is here for you. They are available Monday - Friday 8 a.m. to 8 p.m. ET. Se habla español.