Submitting Claims

Our step by step guide will help you understand how to submit your qualifying claims for reimbursement.

Step 1: Collect your documentation

After you’ve received care from an approved provider, you’ll get an explanation of benefits (EOB) from your health insurance company. It will contain the information required to file a claim.

How to obtain an explanation of benefits (EOB)

The best documentation to submit is an explanation of benefits (EOB) from your health insurance plan.

An EOB is a statement from your health insurance plan that shows the health care services you received. Obtain a copy of your EOB by logging in to your health insurance plan’s online account or by calling your plan’s member services department. Please submit all pages of your EOB. If you access your EOB through your online account, download your complete EOB as a PDF.Learn more about EOBs:

Other accepted forms of documentation

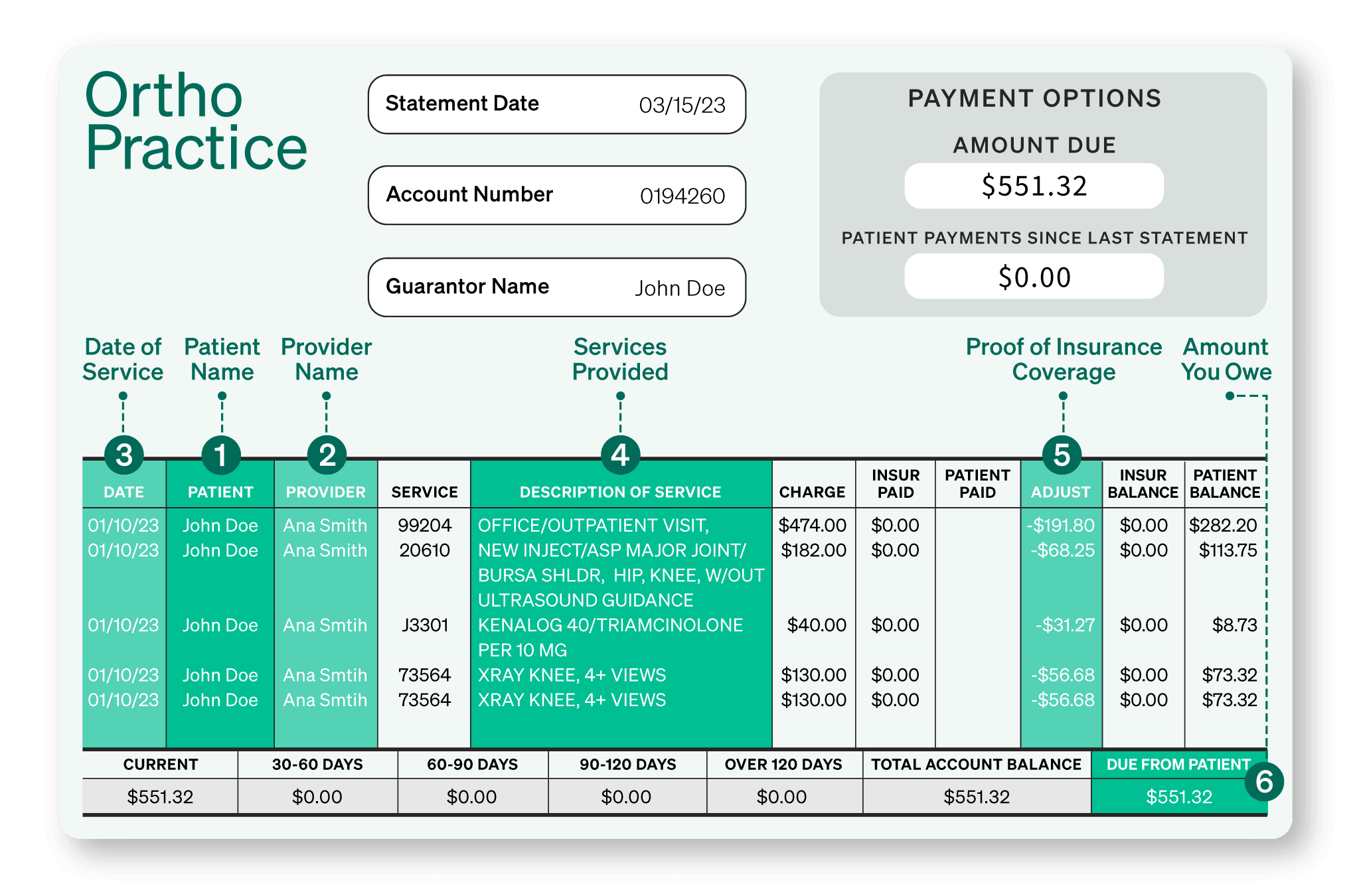

Though it may take longer to process your claim, you may also submit a detailed bill from your provider, hospital or pharmacy as long as it contains the required information.

Detailed bills: A bill from a provider, such as a doctor or hospital, may be used if it shows all of the required information listed above. An insurance “adjustment” or “allowance” that shows that your health plan covered the service must be visible on the bill.

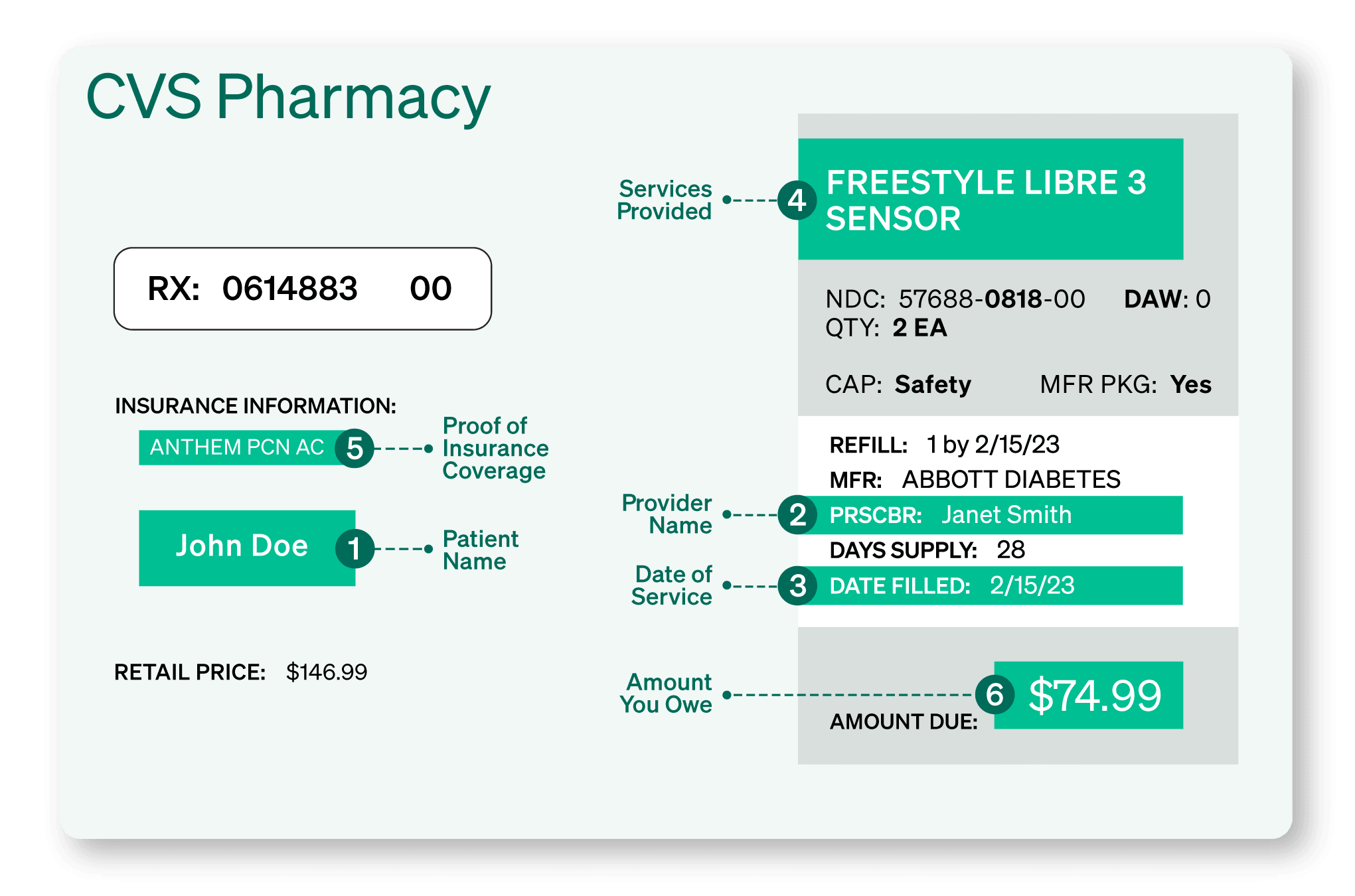

Prescription documentation: If your Garner plan covers prescriptions, you can submit a detailed prescription slip provided by your pharmacy. The prescription slip must show all of the required information listed above. Prescriptions must be processed by your employer-sponsored health insurance plan to qualify for reimbursement. If you use a discount program (ex: Good Rx) or any other program outside of your employer-sponsored health insurance plan, your claim will be denied.

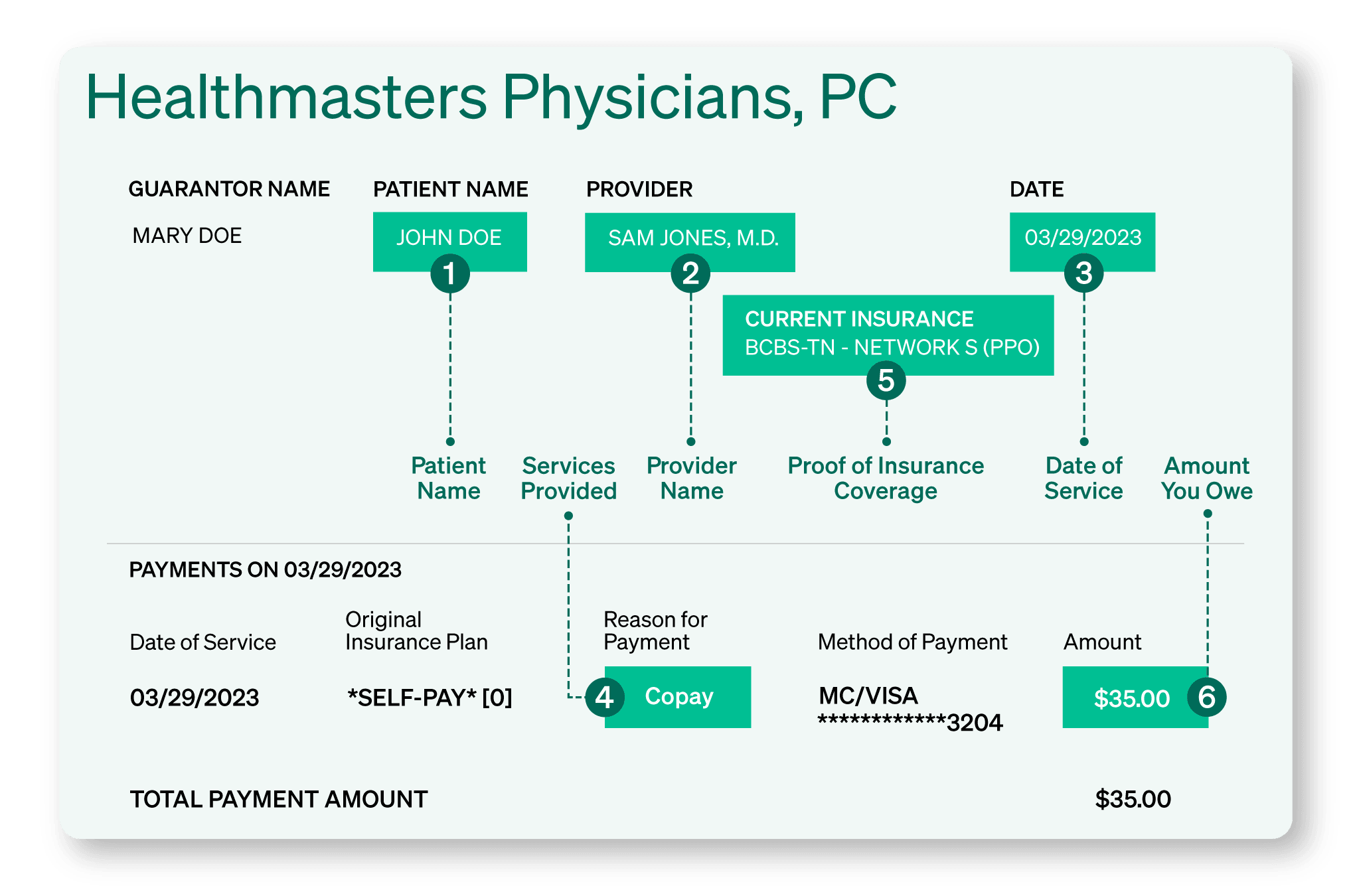

Copay documentation: If you make a copay at a Top Provider’s office, you can submit a detailed receipt as long as it clearly lists that the payment was for a health insurance plan copay. The bill must show all of the information listed above. The amount you owe should correspond to your health insurance plan’s standard copay amounts.

Make sure your costs qualify before submitting a claim

Garner reimburses qualifying out-of-pocket medical costs that include office visits, lab work, imaging and procedures ordered or administered by your approved providers. To learn if other medical costs qualify for reimbursement, log into your Garner account and navigate to the benefit section.

Your out-of-pocket medical costs will qualify for reimbursement if:

You have created a Garner account and added the provider to your list of approved providers prior to the date of service.

Your provider is in-network and the cost was covered by your health insurance plan.

The type of cost qualifies for reimbursement under your Garner plan.

If your health insurance plan is paired with an HSA, you will need to incur costs greater than the minimum deductible.

Step 2: File a claim

Once you’ve collected your documentation, click “Manage claims” on the home screen of the Garner Health app. Claims submitted without an accepted form of documentation or with documentation that is missing required information may be denied.

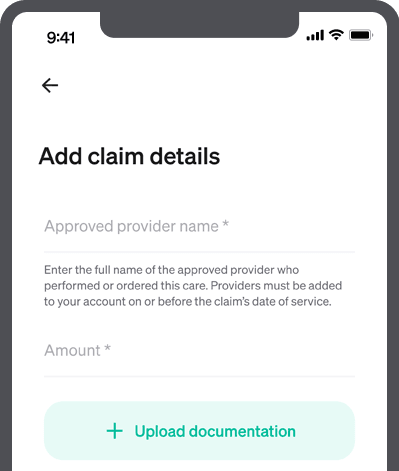

Add claim details

On the “Add claim details” page, fill in the required information. Upload a PDF or clear photo of your documentation. Be sure to include all pages. In the “Approved provider name” field, write in the name of the approved provider who performed or ordered the care. Your approved provider may differ from the provider on the documentation.

Submit claim

Upload a PDF or clear photo of your documentation and be sure to include all pages. Once the documentation is uploaded and you’ve added the required information, click “Submit claim.”

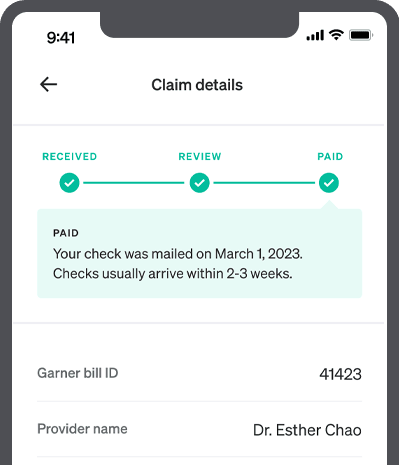

Track claim

You can monitor the status of your claims on the “Claim details” page. Once approved, you will receive reimbursement using their preferred payment method.

You have two options for receiving reimbursement:

If you are the primary member you can set up direct deposit for faster and more secure reimbursement. It typically takes 2-3 weeks after submission for your claims to be reimbursed. Watch this demo video to learn how to set up direct deposit.

If you do not set up direct deposit, a reimbursement check in a white envelope will be sent to the mailing address the primary member has on file with their employer, arriving in about 3-5 weeks.

Can't find the answer you're looking for?

Our dedicated Concierge is here for you. They are available Monday - Friday 8 a.m. to 8 p.m. ET. Se habla español.